Executive Summary

- January 2024 saw US GDP and employment numbers that were stronger than expected. In response, the Fed indicated a delay in rate cuts and the fixed income market saw increase in yields.

- On 10 January, the US SEC approved 11 spot BTC ETFs filed by major asset managers including BlackRock, Fidelity and Grayscale. Net BTC inflows into these ETFs currently stands at 1525 BTC, valued at approximately USD 66 million. Total AUM stands at USD 28.11 billion.

- Bitcoin is currently a strengthening market with a small increase in long terms holders and a spike in short term holders on chain, indicating both investor and speculative interest in the asset.

- Historically, the bitcoin halving has been followed by price appreciations for BTC. However, with block rewards halving in April and a possible shakeout of the miner market, transitioning into non-mining crypto stocks like Microstrategy (MSTR) and Galaxy Digital (GLXY) could be a safe option.

- Ethereum continues to make strides along its roadmap with its Dencun upgrade going live on the Sepolia test network. There are also conversations surrounding validator client diversification within the network.

- Solana unveiled new token standards to make the network more insitution-friendly. The network also grabbed headlines due to the airdrop frenzy around the newly launched JUP and WEN tokens.

Introduction

In January, the cryptocurrency market witnessed significant milestones with the launch of groundbreaking spot BTC ETFs in the US and major token airdrops on Solana.

In this edition of the Digital Investor, we delve into the developments within the cryptocurrency market throughout January 2024. We begin by examining the Federal Reserve’s indication to postpone rate cuts to Q2 of this year, driven by stronger-than-expected employment and GDP numbers. Furthermore, we explore the gradual resurgence of Bitcoin’s strength and analyze the current flow of spot BTC ETFs as of the time of writing this blog. Transitioning to the Ethereum ecosystem, we cover updates regarding its upcoming Dencun upgrade and reflect on the month’s progress within its validator network. Lastly, we assess the implications of Solana’s newly introduced token standards for the network and investigate the heightened activity resulting from recent airdrops on the platform.

Macroeconomy

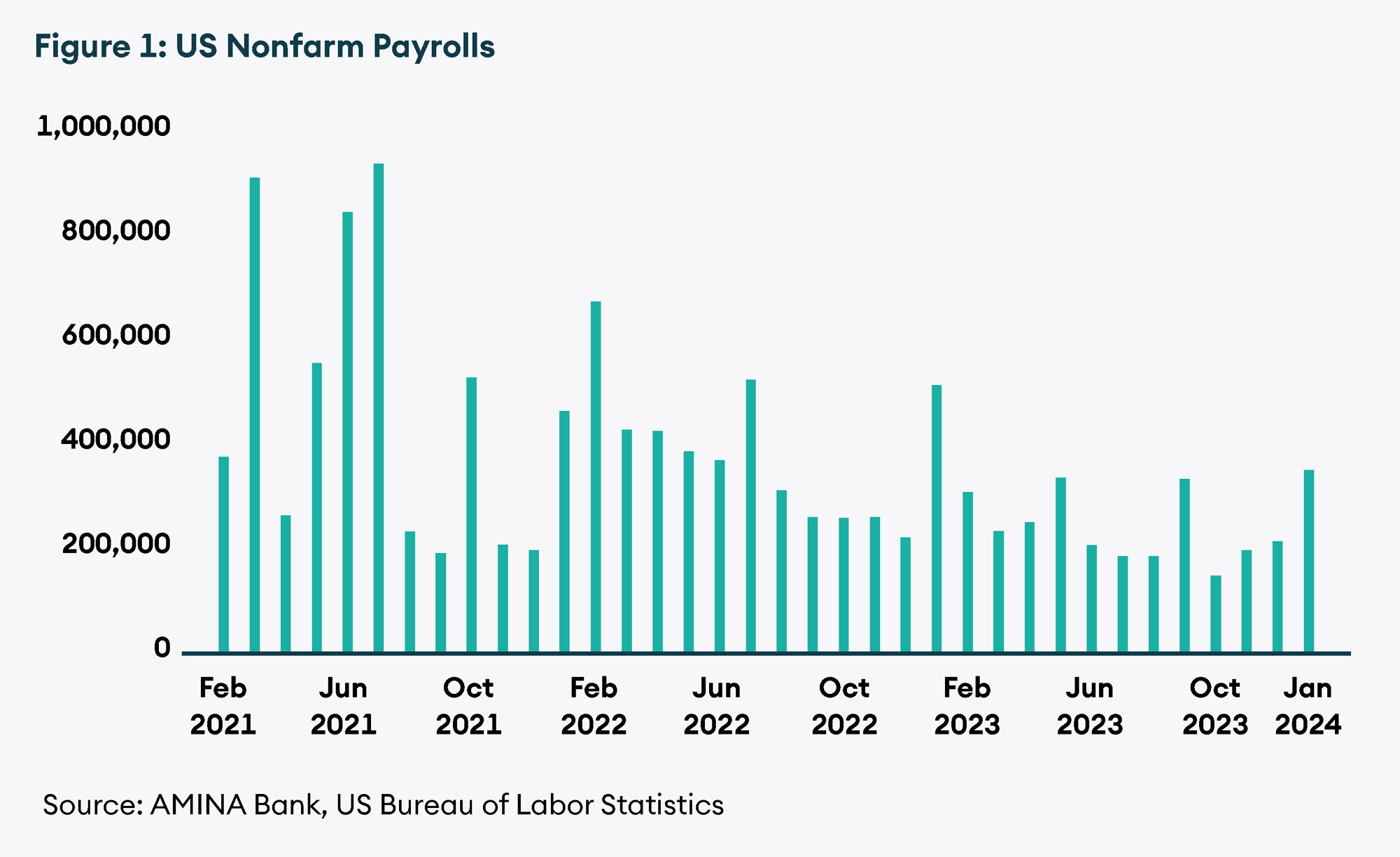

January’s macroeconomic landscape demonstrated remarkable resilience, surpassing expectations with robust performances in both payrolls and GDP figures. The addition of 353K jobs in the US last month beat expectations by a wide margin. This strong figure signals the US economy is in good shape. Strong job creation and low unemployment (3.7%) mean the battle against inflation is not won yet as wage might rise and fuel inflation.

In response, the fixed income market witnessed higher yields, with investors speculating that this news could extend the Fed’s pivot timeline. While prolonged rising yields may potentially impact equity price action, such effects have yet to materialize at the time of writing. Despite acknowledging inflation remaining on the higher side, the Federal Reserve opted to maintain interest rates unchanged for the fourth consecutive time. The Fed’s stance reflects confidence in the effectiveness of their policy, as inflation has moderated without significant job losses. However, the pivot moment appears to be deferred, with the market anticipating the possibility of the first rate cut at the May meeting. This strategic maneuver underscores a nuanced and cautious approach to monetary policy. Against this backdrop, the tech and communication sectors emerged as standout performers for January, further highlighting the market’s resilience and adaptability amidst evolving economic dynamics.

The ETF story thus far

The SEC’s approval of 11 spot Bitcoin ETFs on January 10 marked a groundbreaking moment in the cryptocurrency market. This unprecedented move represents a significant stride towards seamlessly integrating cryptocurrency into the established framework of traditional finance. The impact of this decision on Bitcoin’s price was palpable, with it soaring to multi-year highs before experiencing an 18% decline attributed to derivatives leverage and spot profit-taking. Despite Bitcoin’s presence in mining, purchase, and trading for over a decade, the introduction of ETFs emerges as a pivotal step, aligning cryptocurrency more closely with the current infrastructure of the financial market.

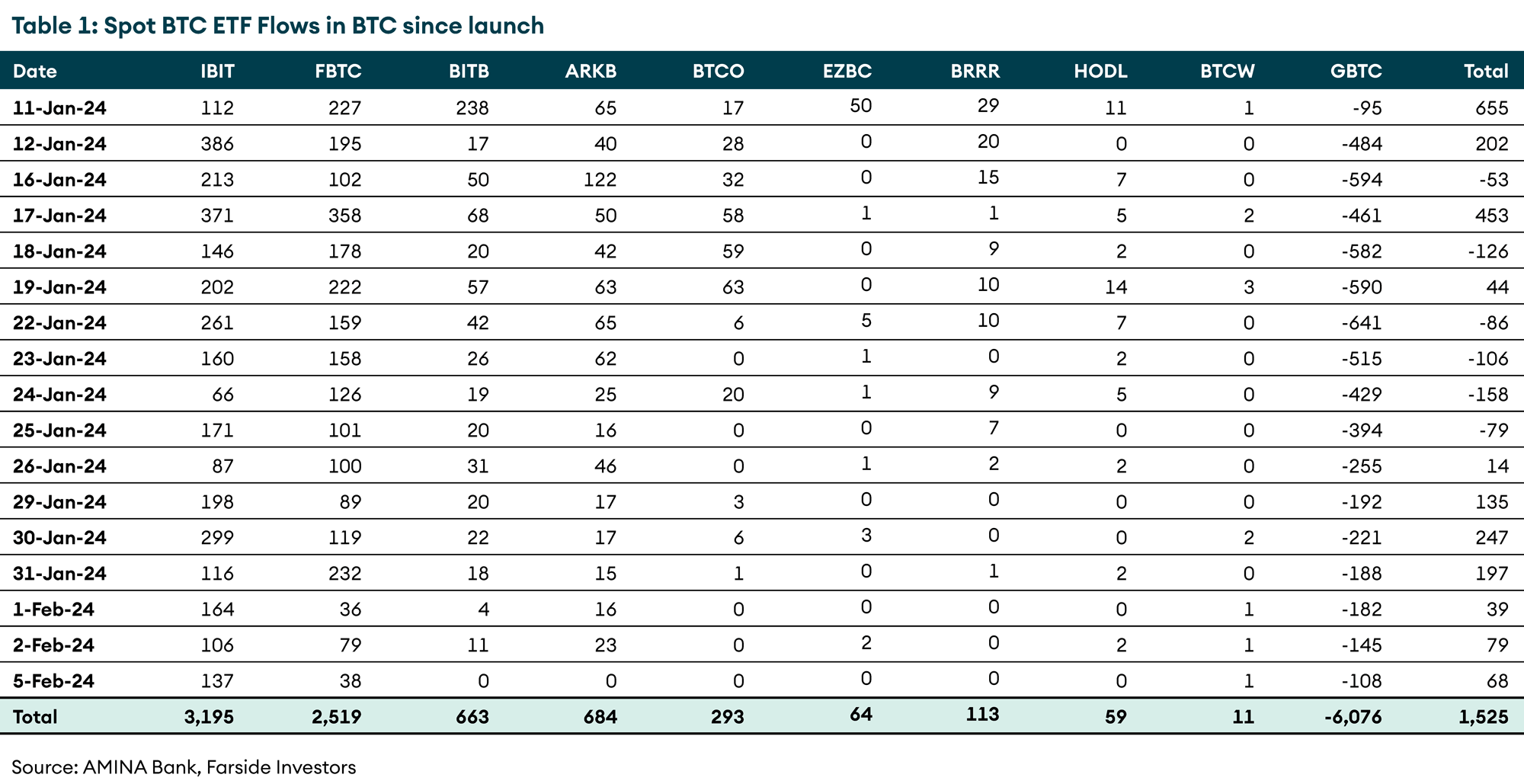

In the emerging ETF landscape, BlackRock’s iShares ETF (ticker: IBIT) has notably stood out, recording an impressive influx of nearly 3195 BTC at the time of writing. Fidelity (ticker: FBTC) is another major player, contributing significantly with 2519 BTC in inflow. However, Grayscale’s GBTC has faced a cumulative outflow of over 6K BTC, largely attributed to its 1.5% fees, contrasting with the lower fees of its counterparts.

Overall, the demand for ETFs remains robust. The decline in outflows from GBTC is notable, as inflows through IBIT and FBTC contribute to an overall increase in BTC holdings through these ETFs. Since the launch on January 10, the total net inflow has reached 1525 BTC, valued at approximately USD 66 million at current prices. Total AUM across the 11 ETFs stands at USD 28.11 billion.

With institutional investors gaining easier access, the anticipated growth in Bitcoin demand is significant. Calculations suggest inflows of USD 50-100 billion into the spot ETF this year. The SEC’s decision reflects a broader acceptance of cryptocurrency, particularly among younger investors favoring crypto over traditional mutual funds. For a comprehensive understanding of the approval of these spot BTC ETFs and the outlook, delve into our in-depth research linked here.

Bitcoin

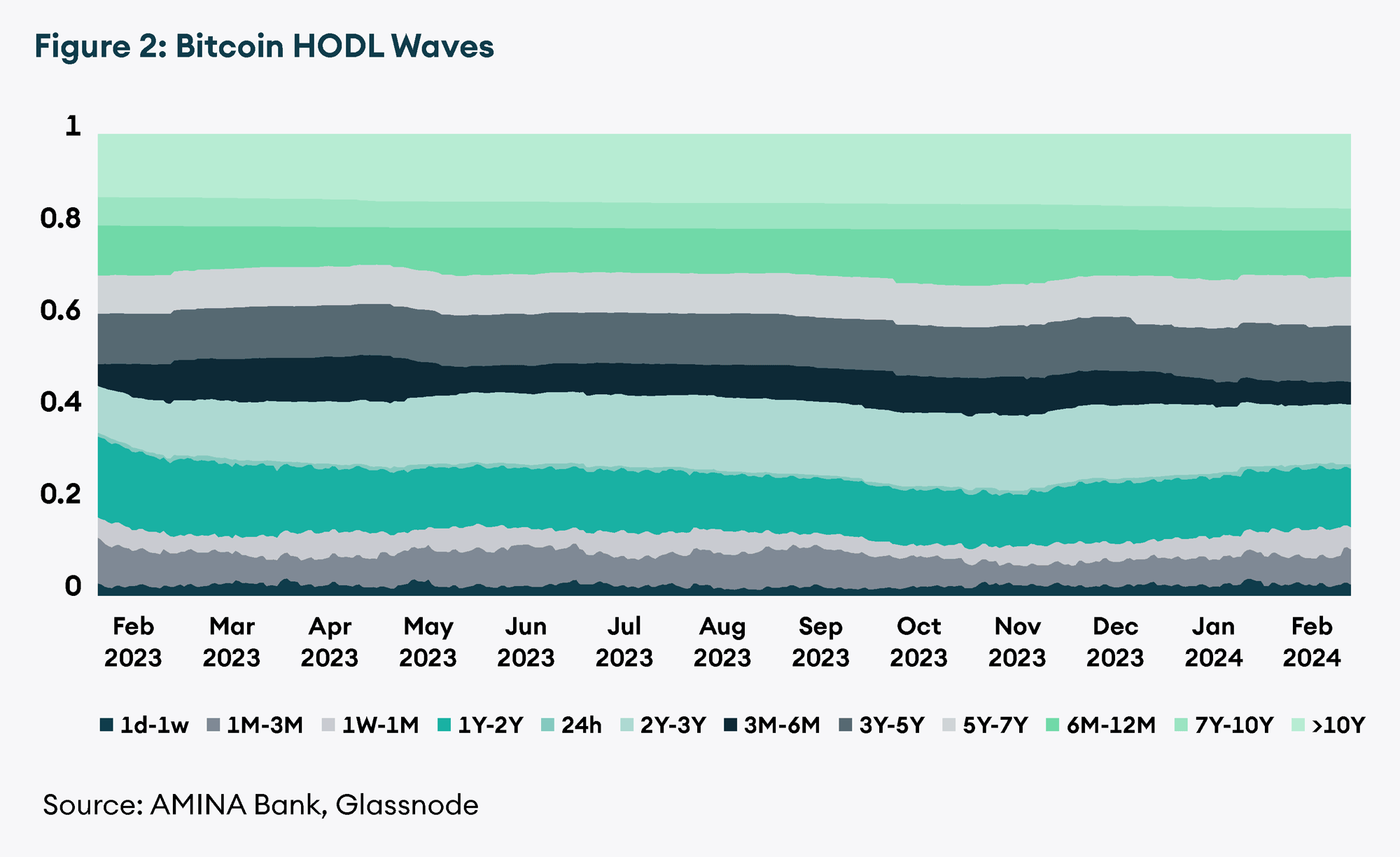

The Bitcoin network has recently experienced a decline in both the absolute and relative number of inscription transactions, contrasting with a surge observed in late Q4 of 2023. However, this trend has since subsided, with attention shifting towards spot BTC activity, which has seen a notable uptick across various cohorts. Medium-term holders have largely been reducing their holdings, while long-term holders are actively buying. Notably, short-term holders have seen a rapid rise, especially amidst recent market volatility following ETF approvals.

Users with less than 1 BTC have accumulated approximately 700 BTC daily over the past two weeks, alongside the mining of 900 new BTC each day, set to halve to 450 per day in April. Despite fluctuations, the Bitcoin market is displaying signs of increasing strength, with evident accumulation reflected in HODL waves, signaling increased buying activity among long-term holders. Concurrently, short-term holders are spiking, potentially indicating heightened speculative interest in Bitcoin, expected to shift towards Ethereum and other altcoins as Bitcoin dominance declines. Additionally, after a brief pullback, the Bitcoin network hashrate is once again surging to new all-time highs, presently at roughly 535 EH/s, expected to continue climbing leading up to the halving as miners adopt the latest-generation, energy-efficient ASICs.

Crypto Equities

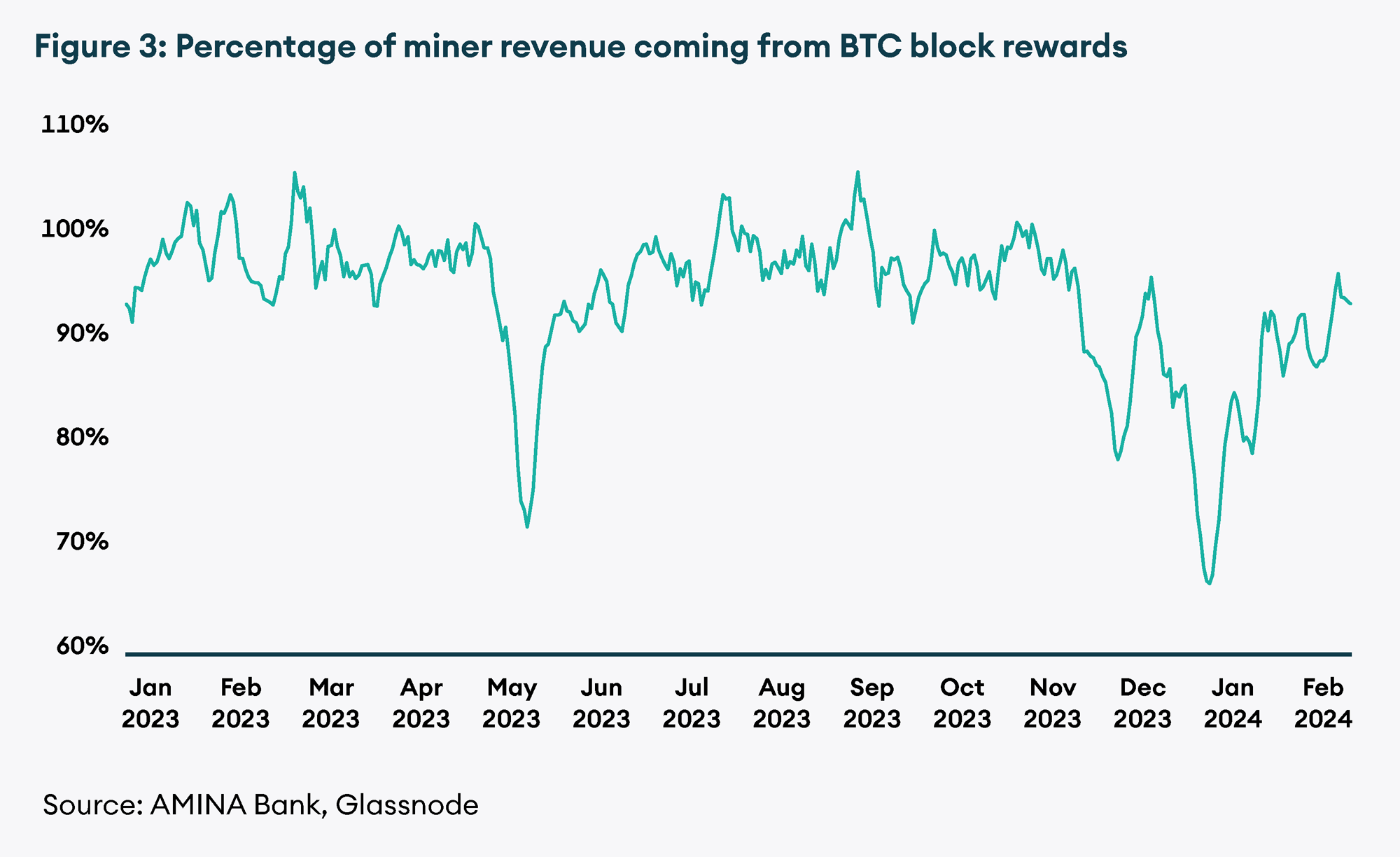

According to Blockware Intelligence, miner revenue per tera hash per day currently stands at USD 0.08, as new generation Bitcoin , serving as a cost basis for miners. At the time of writing, 93% of miner revenue is coming from block rewards. This shows the importance of the halving event to the mining industry.

With the impending halving in April, we anticipate a following the reduction in block rewards, potentially resulting in a decline in miner profitability. To maintain current revenue levels, the reduction in block reward must be offset by transaction fees. This necessitates either increased on-chain activity in Bitcoin or a resurgence in interest in inscription transactions. Historically, BTC’s price has appreciated post-halving due to the drop in new supply through block rewards.

However, for investors seeking stability around the halving episode, transitioning into non-mining crypto stocks like Microstrategy (MSTR) and Galaxy Digital (GLXY) could be an option. Such a shift would mitigate exposure to the risks associated with miner earnings fluctuations while providing exposure to Bitcoin holdings present on these companies’ balance sheets. For instance, Microstrategy currently boasts a holding of over 189K BTC and continues to accumulate. To explore a comprehensive list of institutional Bitcoin holdings, refer to the provided link.

Ethereum

In the most significant upgrade since early 2023, the Ethereum blockchain marked another milestone with the launch of the second of three test networks, Sepolia. This development brings the highly anticipated Dencun project and its proto-danksharding feature one step closer to fruition. Scheduled for deployment on the final Ethereum testnet, Holesky, on February 7, Dencun signifies a crucial progression in Ethereum’s evolution. Proto-danksharding, a pioneering aspect of Dencun, aims to alleviate transaction costs for layer-2 blockchains while also reducing data availability expenses by introducing a novel compartmentalized space for data, known as blobs. With the rapid expansion of layer-2 chains atop Ethereum, this upgrade is deemed essential for the ecosystem’s roadmap, supporting its continued growth and development.

Despite a promising future for Ethereum, a minor setback occurred last month when one of its software clients, Nethermind, encountered a bug that temporarily took validators offline for a four-hour stretch. These software clients play a crucial role in enabling users to interact with the blockchain, facilitating transactions and the execution of smart contracts. The incident with Nethermind has raised concerns about the potential impact if Geth, Ethereum’s most widely used execution client, were to face similar issues. With 84% of all validators relying on Geth, an outage could prevent Ethereum from finalizing new blocks. This has reignited discussions around the necessity for client diversification among Ethereum validators. Notable responses to these concerns include Coinbase Cloud, a prominent company, acknowledging the importance of diversification as their nodes currently depend solely on Geth due to meeting their technical requirements. However, they are actively exploring other client execution layers to broaden their options. Other validators, such as Allnodes, P2P, and Aave-Chan, have also announced their initiatives towards client diversification.

Solana back in the spotlight

New token standards

In January, Solana unveiled 13 new token extensions as part of its strategy to attract traditional businesses to the blockchain. These extensions provide token issuers with enhanced functionalities that were previously only achievable through smart contracts. They empower businesses to establish tailored rules governing token interactions, such as restricting transfers to individuals who have undergone anti-money laundering and know-your-customer checks. Through the integration of token extensions, projects can construct permissioned ecosystems within a permissionless blockchain framework. For instance, businesses can impose transfer limitations based on users’ completion of know-your-customer checks or mandate the inclusion of memos with each transfer, enriching transactional context.

Moreover, companies can leverage extensions incorporating zero-knowledge (zk) proof technology to confidentially pay employees without disclosing the total transfer amount. This ensures the privacy of sensitive financial data, enabling individuals to receive their crypto-based salaries discreetly without exposing the transaction details to the public eye.

Among the 13 extensions introduced, two stand out as particularly significant, granting token issuers the authority to dictate user interactions with a token and to conceal transfer amounts between users. Several projects within the Solana ecosystem have swiftly embraced these advancements, with notable integration from leading wallet providers like Phantom and Solflare. Additionally, popular platforms such as a Telegram trading bot and a decentralized exchange, Fluxbeam, have also implemented these new features, showcasing the rapid adoption of these innovative functionalities within the Solana ecosystem.

More airdrops

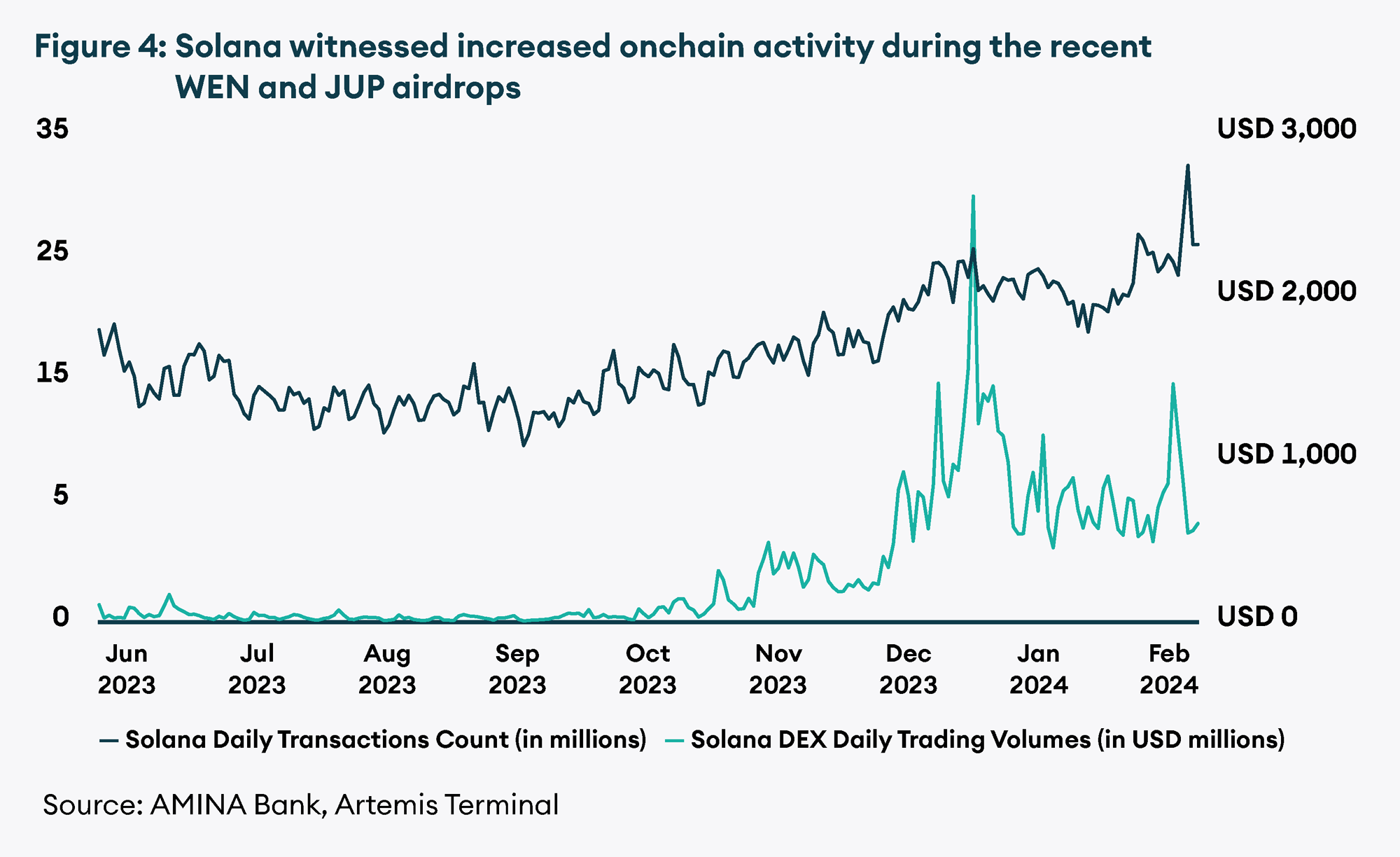

On January 31, the cryptocurrency market experienced one of its most significant token airdrops to date, as Jupiter, a decentralized trading aggregator built on Solana, launched its native token, JUP. Preceding this event, Jupiter developers introduced hype for the Jupiter through another airdrop, distributing the memecoin WEN. Utilizing Solana’s new token extensions and Jupiter’s LFG launchpad, WEN was airdropped to over a million wallets, including active Jupiter users, top NFT collection holders, and genesis Saga phone holders. The immediate rise in value of the one trillion WEN tokens to over USD 100 million served as a proof of concept for the WEN New Standard (WNS), a lightweight token standard for NFTs on Solana developed by LFG. WEN, fractionalized into one trillion fungible tokens, also served as a stress test for Jupiter’s infrastructure, its bot mitigation measures and the Solana network. Subsequently, Jupiter’s utility token, JUP, was launched, distributing approximately USD 700 million worth of tokens to nearly a million wallets. Despite initial challenges faced by some RPC nodes, the Solana network maintained stability, processing claims and trades on decentralized exchanges with minimal issues. JUP’s price surged over 75%, reaching USD 0.72 and pushing its fully diluted market cap above USD 6 billion. Centralized exchanges, including Bybit, Binance, Bitfinex, and Okx, had listed JUP in anticipation of the launch. The success of this launch not only benefits JUP holders but also instills confidence in the scalability and reliability of the Solana network.

The airdrop generated unprecedented levels of trading activity, with Solana-based DEXs facilitating trades totaling USD 1.14 billion during the 24 hours preceding the airdrop, surpassing Ethereum-based platforms. Crypto wallet provider Phantom and data analytics firm Artemis reported record traffic levels during the JUP airdrop, underscoring the network’s growing prominence in the cryptocurrency space.

Conclusion

At the end of January, reflections on the month’s events reveal a landscape marked by innovation, resilience, and cautious optimism. As investors anticipate the potential impacts of rising yields on equity markets, the tech and communication sectors stand out as beacons of performance amidst evolving economic dynamics. Bitcoin is gaining strength and is in a consolidation phase before we can see its next leg up. Ethereum too is committed to its roadmap and is making strides in the right direction. With Solana consolidating its position as a contender for the leader position in the alt-L1s space, the competition for other networks looks tough. The spot BTC ETF approvals have laid the foundation for institutional adoption of bitcoin. Moving forward, the lessons learned and strides made in January set the stage for continued growth and adaptation in the months to come.