Executive Summary

- Bitcoin surged 43% in February, hitting its strongest performance since December 2020 and OTC desk balances of the largest cryptocurrency dropped to a six-year low amid rising demand.

- Ethereum’s price rose 37% driven by expectations of a spot ETF approval and increased on-chain activity dominated by DeFi, L2 sequencers, and NFT projects.

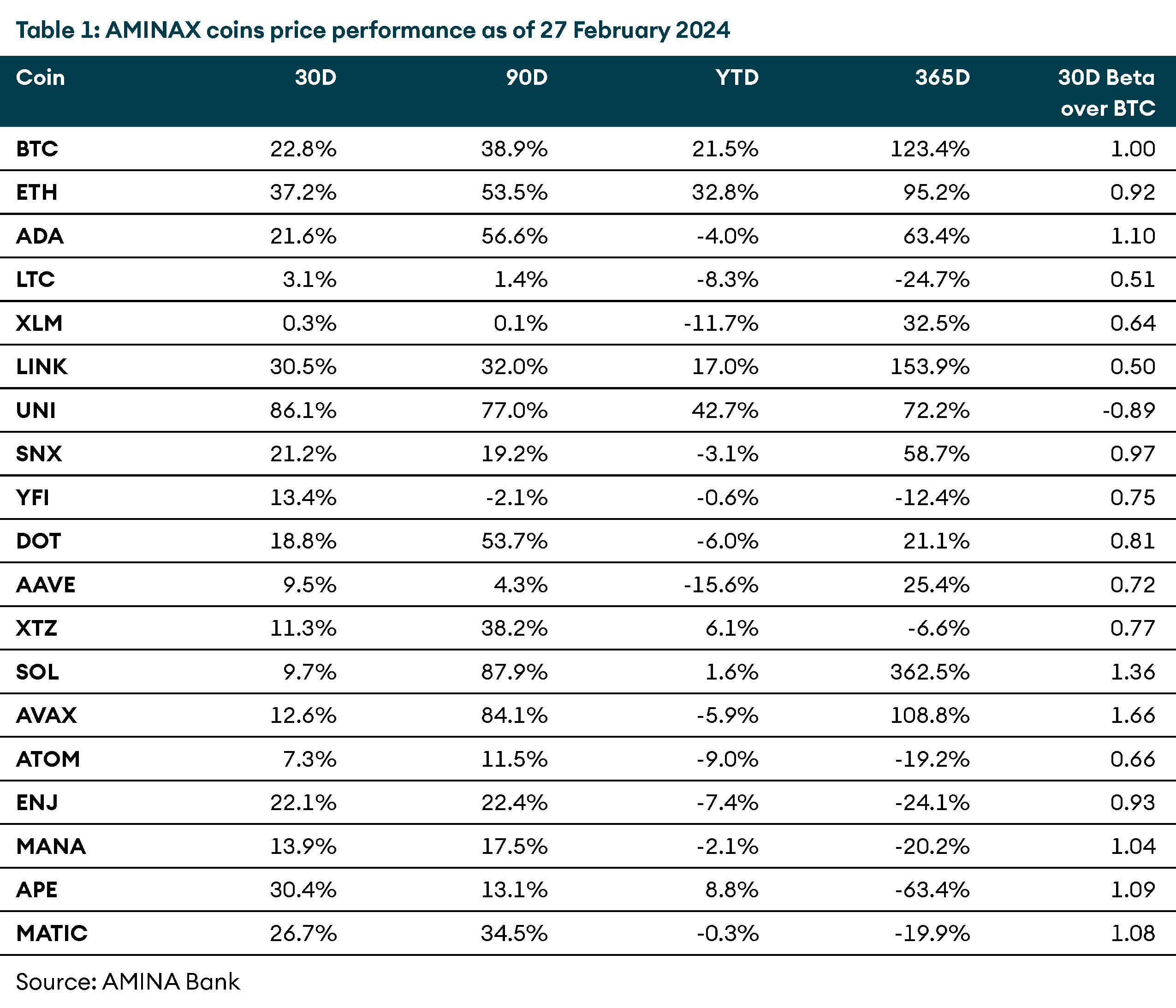

- Decentralised exchange Unswap’s UNI token saw an 86% gain, with a negative 30-day beta over BTC, making it a standout performer among altcoins.

- Solana continued to maintain steady growth, positioning itself as a top contender for the third major cryptocurrency spot, with a 10% increase in daily active addresses over the past 30 days.

- Looking ahead, Ethereum’s Dencun upgrade on March 13 is expected to reduce gas fees, preserve Ethereum Mainnet’s market share and lead to a surge in onchain activity.

- We expect the upcoming Halving in April to be a bullish catalyst for bitcoin and for the broader cryptocurrency market.

Introduction

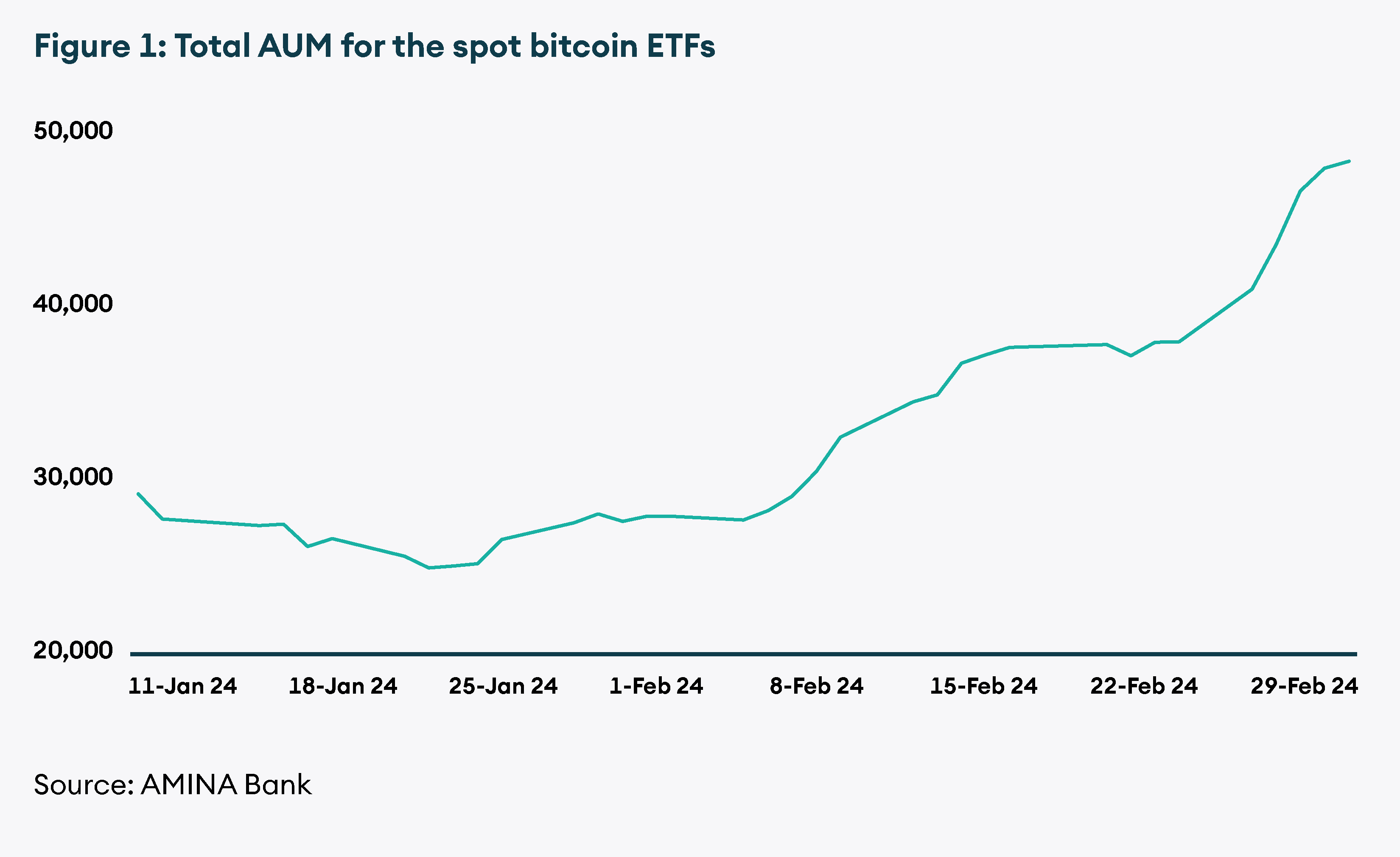

In February 2024, the cryptocurrency market experienced significant gains, with Bitcoin leading the charge. Bitcoin saw its most significant monthly increase since December 2020, soaring over 43% in the past 30 days. This surge was fueled by robust inflows into spot Bitcoin ETFs, with cumulative volumes nearing USD 80 billion by the time of this report These ETFs also experienced a surge in trading volume towards the end of February, surpassing USD 7 billion in 24-hour trading volume, the highest since their approval in January.

Ethereum also experienced a notable uptick in February, marking its highest monthly gain (37%) since July 2022 This increase was driven by heightened interest and optimism surrounding the potential approval of a spot Ether ETF The imminent Dencun upgrade on the Ethereum network is expected to further catalyze activity, thanks to a significant reduction in gas fees.

Additionally, Uniswap’s decentralized exchange garnered attention as its governance contemplated revenue sharing among UNI stakers, resulting in a staggering 60% rally within a single day.

Altcoins also rallied in February, with UNI standing out, ending the month 86% higher. Other top performers included Chainlink’s LINK token (+30%), Apecoin (+30%), and Polygon’s MATIC (+26%).

Looking ahead, the upcoming Bitcoin halving, estimated to occur on April 20, is anticipated to serve as a positive catalyst, aligning with historical trends that have favored Bitcoin’s price trajectory following previous halving events.

Macroeconomy

The strong US job market numbers set a positive tone, with the economy adding 353k jobs in January and maintaining a steady unemployment rate of 3.7%, alongside reaccelerating wage growth. However, higher-than-expected inflation remains, prompting anticipation for a soft landing as economic conditions gradually stabilise and inflation edges closer to the Fed’s 2% target.

Meanwhile, the Federal Reserve opted to keep the federal funds rate unchanged at 5.25%–5.50% during the January Federal Open Market Committee (FOMC) meeting, signaling a shift away from its tightening bias. Speculation looms regarding potential rate cuts, with markets eyeing possibilities for adjustments later in the year, particularly in May. Overall, equity markets remain optimistic, poised for growth in the short term.

Bitcoin

February marked a significant milestone for Bitcoin, showcasing its strongest performance since December 2020, with a remarkable surge of over 43% in the past 30 days. This surge, attributed to robust ETF inflows and heightened interest from short-term buyers, has driven the cryptocurrency’s price action. Cumulative volumes for the spot bitcoin ETFs are almost USD 80 billion.

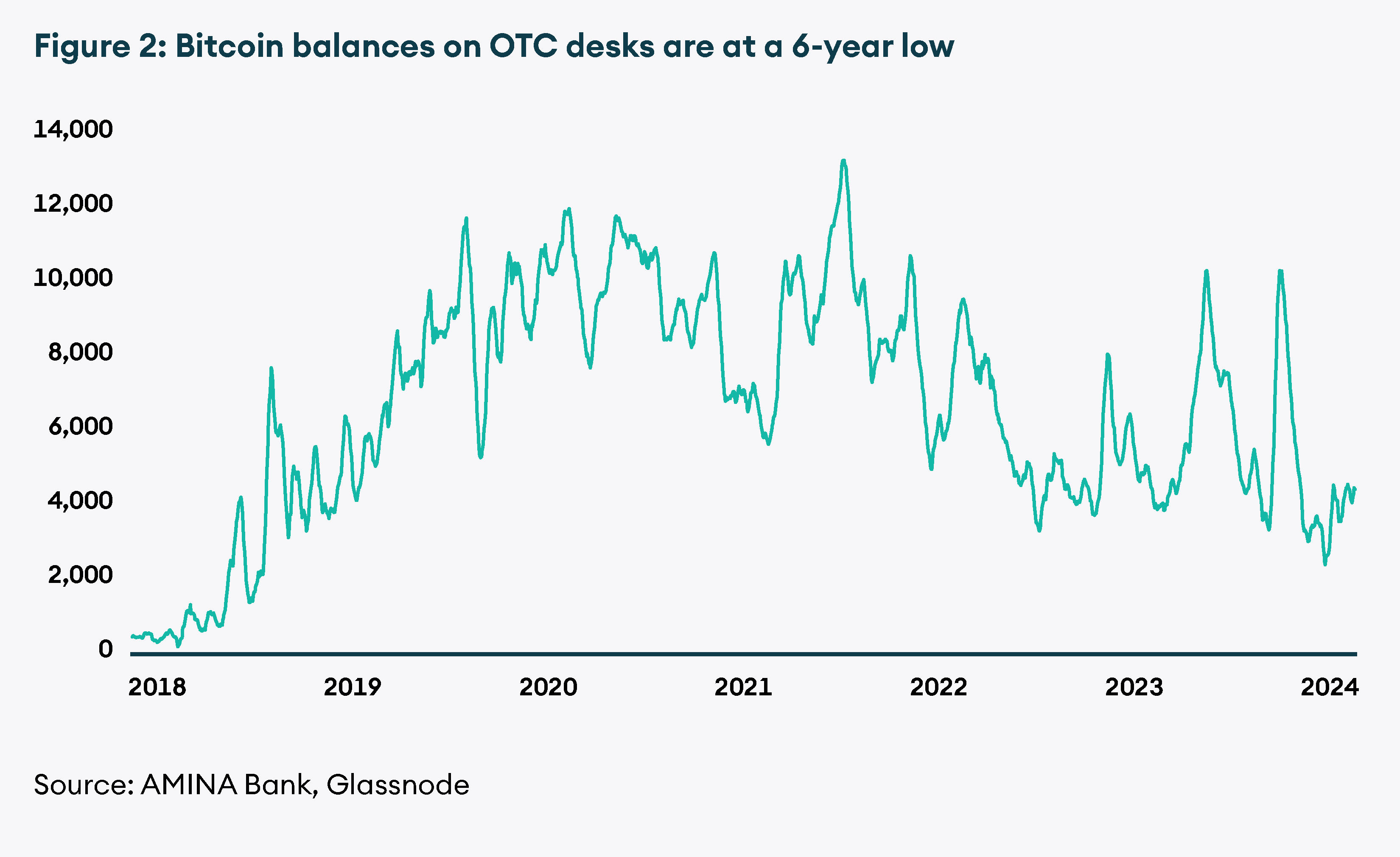

This surge in demand reflects an increasing appetite for Bitcoin and a change in behaviour between short-term and long-term holders, signaling that speculative activity is coming back. Additionally, Glassnode data reveals that Bitcoin balances on OTC desks have plummeted to a six-year low amid surging demand, potentially exacerbating the supply crunch and propelling Bitcoin to new highs.

The impending Halving, scheduled for April 20 after block number 740K, will reduce the block reward from 6.25 BTC to 3.125 BTC, marking the fourth halving in Bitcoin’s history. Historically, previous halving events have served as bullish catalysts for Bitcoin and the broader cryptocurrency market. For further insights into the upcoming Halving, readers are encouraged to explore our recent report.

Ethereum

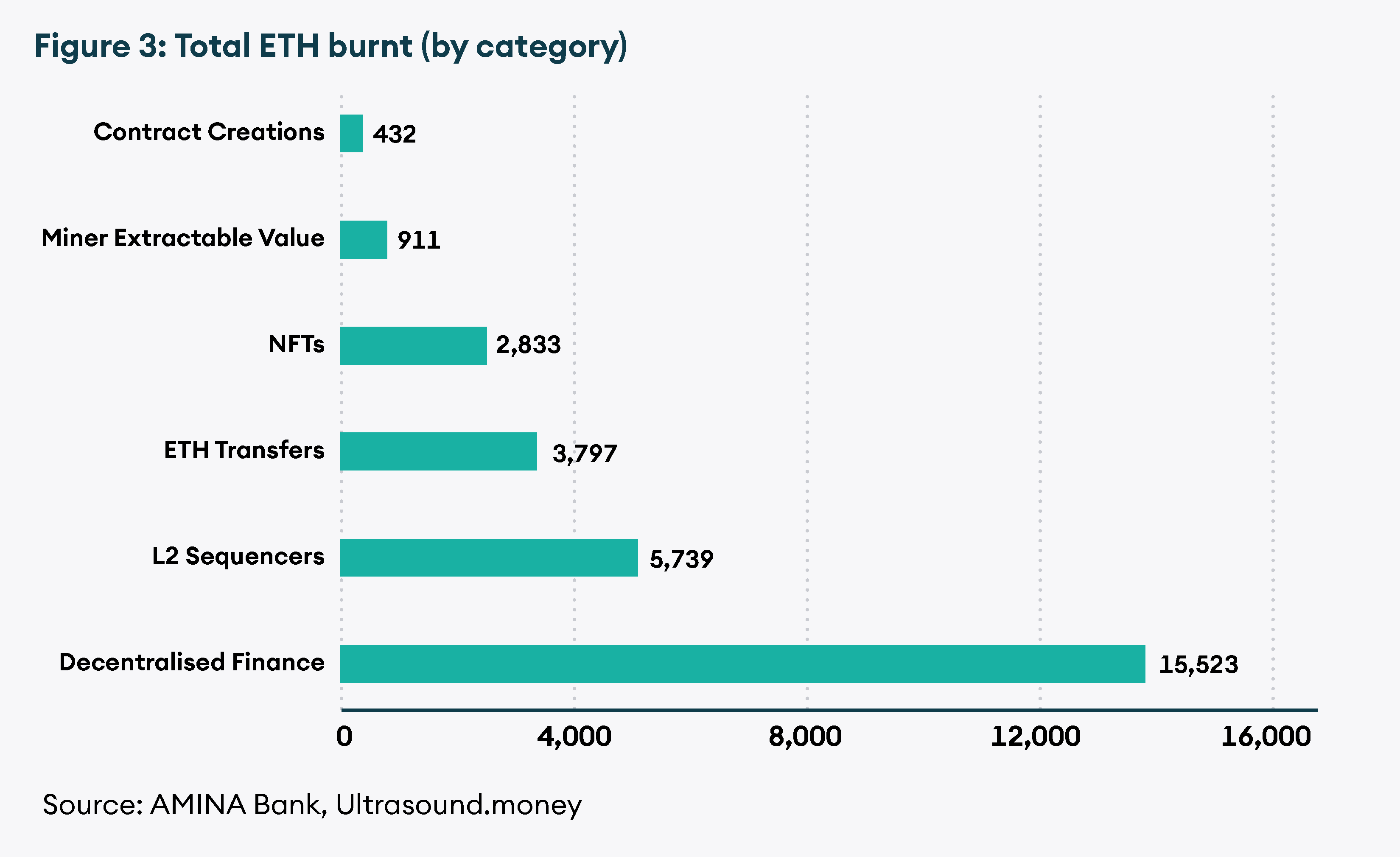

In February, Ethereum price rallied by 37%, due to expectations of the approval of a spot ETF. This surge coincided with a boom in onchain activity, underlining Ethereum’s expanding ecosystem. Notably, Uniswap emerged as the top gas-consuming protocol, followed by ETH transfer transactions and interactions with Tether’s USDT stablecoin contract. DeFi activities dominated the sector, with L2 sequencers and NFT projects following suit.

L2 solutions continued to gain momentum, eroding the mainnet’s market share due to competitive gas fees. This is evidenced by Mainnet’s high gas fees averaging over USD 23.5 million while layer-2 solutions Arbitrum and Optimism contributed less than USD 1.2 million combined. After the imminent Cancun-Deneb upgrade, also referred to as the Dencun upgrade, there’s a potential for a slowdown in L2s eating away Mainnet’s market share.

The upgrade, slated for deployment on the mainnet on 13 March, aims to enhance gas efficiency through a series of Ethereum Improvement Protocols (EIPs), notably EIP-4844 for proto-danksharding. Understanding EIP-4844 requires familiarity with sharding and danksharding concepts.

Essentially, sharding involves dividing databases into smaller segments to boost efficiency and performance. Ethereum’s adoption of danksharding, a form of sharding, is anticipated to reduce transaction costs and increase throughput, potentially elevating Ethereum’s TPS to approximately 100K. Currently, the Ethereum base layer processes around 15 TPS, while layer 2 rollups manage about 100 TPS.

Despite being rough estimates, danksharding’s impact is expected to be substantial, enabling Ethereum to scale significantly. Within the Dencun upgrade, EIP-4844 (proto-danksharding) precedes full danksharding implementation. EIP-4844 introduces a new transaction type that accepts data blobs, allowing each block to accommodate more data without enlarging individual block size. Blobs, though temporary and invisible to the Ethereum Virtual Machine (EVM), reside on the Ethereum consensus layer, offering cost-effective storage compared to traditional blocks.

The implementation of EIP-4844 is projected to deliver noticeable enhancements, particularly in faster transactions and reduced fees. For those curious, a group of OP stack developers has developed this tool to estimate potential cost reductions for transactions on their networks post-upgrade.

Uniswap’s fee switch

During February, the UNI token emerged as a standout performer, boasting an impressive gain of nearly 86%. Notably, the token exhibited a negative 30-day beta over BTC, indicating reduced exposure to the crypto market’s systematic risk for portfolios holding UNI.

Such a performance followed the Uniswap Foundation’s proposal on the Uniswap Protocol Governance, aiming to reward UNI token holders through fee mechanisms. The proposed governance upgrade seeks to facilitate the collection of protocol fees and their pro-rata distribution to token holders who have staked and delegated their UNI votes. Furthermore, it aims to maintain governance control over core parameters surrounding fees. The team highlighted the importance of potential governance changes, including the necessity of delegation for UNI token stakers, to uphold Uniswap’s leading position in the DEX market.

However, readers should note that previous attempts to activate the fee switch through Uniswap’s governance forum have been unsuccessful. However, if this proposal gains approval, it is anticipated that Uniswap will further solidify its status as the leading DEX in the crypto sphere. Additionally, the market may witness the onset of a new DeFi Summer, with established DeFi coins experiencing a resurgence as they emulate Uniswap’s approach of returning fees to token holders.

Despite these positive developments, the fee switch may bring back concerns regarding UNI potentially resembling a security. It may thus once again attract regulatory scrutiny from U.S. regulators, particularly given that most of the Uniswap team is based in the U.S.

Solana

Solana continues its upward trajectory month after month, positioning itself as a leading contender for the third major cryptocurrency spot alongside Bitcoin and Ethereum. The expanding Solana ecosystem is evident from the metrics, with a notable 10% increase in daily active addresses observed over the past 30 days.

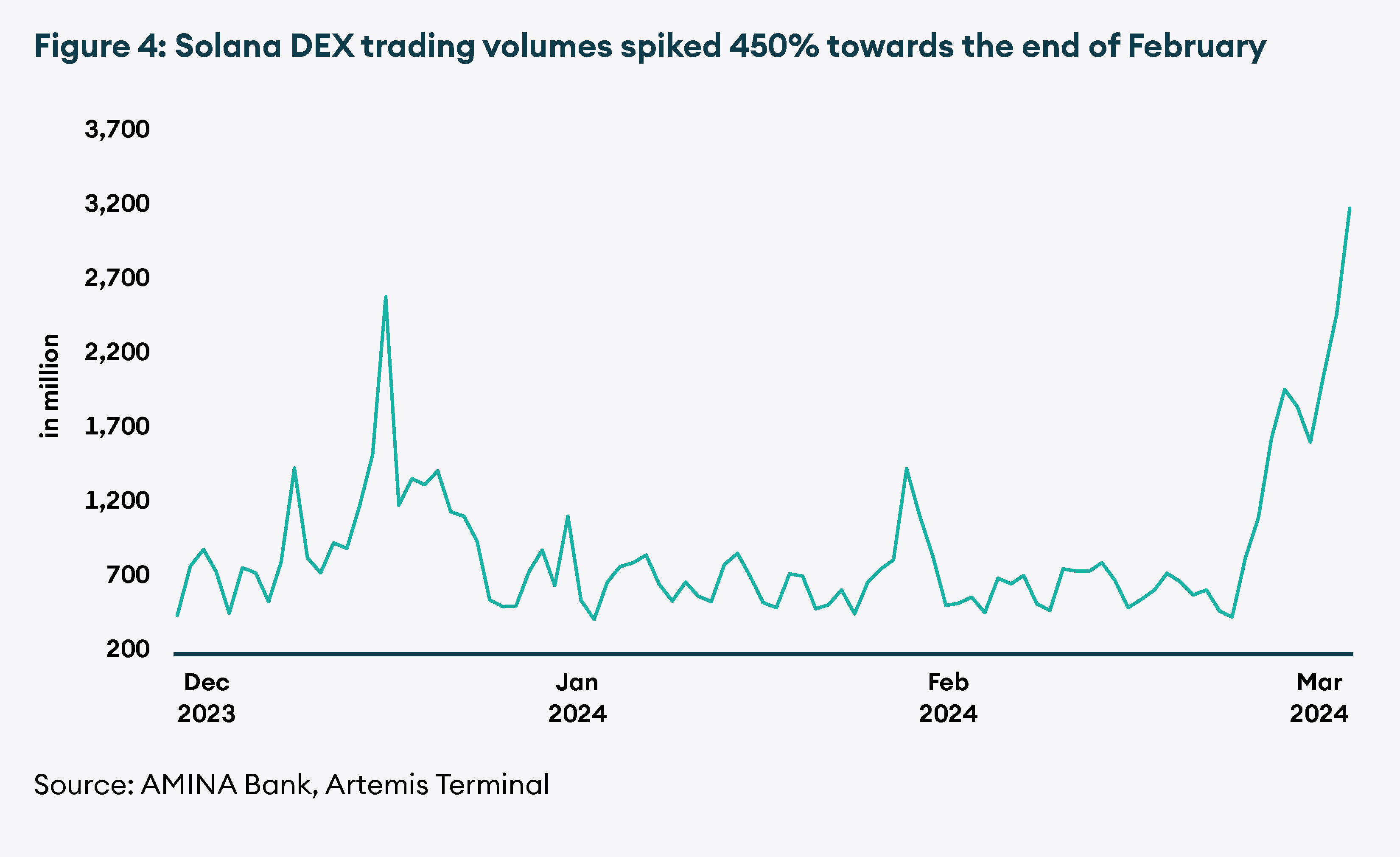

Although the average daily number of transactions experienced a 15% decrease, spikes in activity were notable, particularly post-February 25th, coinciding with the surge in meme coins dominating crypto-Twitter and leading to a 450% increase in DEX trading volumes.

Additionally, fees surged by 138% during this period. The network’s appeal lies in its ability to provide a user experience akin to a Centralized Exchange (CEX) while operating as a decentralized Layer 1 (L1) network. Recent weeks have highlighted this, with Solana’s gas fees remaining as low as USD 0.001, significantly lower compared to Ethereum L2s averaging between USD 5-7 and Ethereum Mainnet fees reaching as high as USD 60 amid heightened activity.

Overall, interest in Solana is on the rise, demonstrated by a substantial 60% increase in total value locked (TVL) in DeFi. As Solana continues to evolve and attract increasing interest from market participants, we remain optimistic about its future prospects within the broader crypto landscape.

Conclusion

February brought considerable excitement for crypto traders, with both Bitcoin and Ethereum experiencing notable rallies. While altcoins also joined the surge initially, they began to retreat towards the end of the month as liquidity flowed back into the two major cryptocurrencies. Bitcoin’s dominance saw a near 2% increase, while Ethereum’s remained relatively flat at similar levels.

Altcoin dominance initially rose but later receded, making room for Bitcoin’s resurgence. Presently, crypto open interest continues to climb as speculative interest intensifies. However, caution is advised for investors bullish at these levels, given the heightened volatility. Leveraging positions may pose risks to portfolios, emphasizing the prudence of spot trading. As Bitcoin’s next halving and Ethereum’s Dencun upgrade draw nearer, anticipation mounts for significant increases in trading volumes.

These events are poised to fundamentally transform their respective networks, potentially catalyzing major market shifts. Furthermore, the US SEC is currently reviewing spot Ether ETF applications. If greenlit, we anticipate a stronger bull market, especially following a pivot by the Federal Reserve.