2024 stands as a pivotal year for Bitcoin. After the first three Halvings Bitcoin prices increased and reached new all-time highs. With the upcoming Halving event in April, the question of whether a post-cycle rally will materialize is in the minds of all crypto investors.

In this research piece, we look at historical Halving events, current miners’ profitability, and recent regulatory developments to give a detailed and timely overview of what price action can be anticipated post-Halving.

Overall, our analysis draws a constructive scenario for the future of Bitcoin and its mining industry. If the April Halving event rhymes with previous Halvings, Bitcoin price should continue to increase and test new ATHs.

Key Takeaways

- The year 2024 is identified as a crucial timeframe surrounding the Bitcoin Halving, extending from 115 days before to 250 days following the event. Since 2014, returns within this specific period have significantly outperformed other periods by a factor of 4.8.

- A historical analysis of price development in the two years preceding and following Halvings shows that there is a strong seasonal pattern around Halvings. Crypto summers usually start at Halving and lead to new all-time highs.

- The phenomenon known as crypto spring, characterized by a recovery phase from the last Bitcoin price trough of crypto winter has shown remarkable warmth in 2024. This warmth is largely attributed to the approvals of BTC Spot ETFs and the associated capital inflows, indicating sustained institutional interest.

- The Ordinals protocol has catalyzed a surge in demand for Bitcoin’s block space, presenting an exceptional opportunity for miners. This has led to a 336% increase in transaction fees year-over-year.

- Miners prioritize enhancing their fleet’s energy efficiency (measured in Joules per terrahash) over expanding their operational capacity. Public mining companies have committed over $1.53 billion to acquire over 94 EH (Exahash) of mining equipment throughout 2023.

- Improved mining equipment energy efficiency should help miners to cope with the Halving that halve their return on mining. Mining activity should expand further this year and reach between 650 and 700 EH by year’s end, notwithstanding an expected 10-20% reduction post-Halving due to the exit of less profitable mining operations.

- The emergence of Bitcoin ETFs poses a potential shift in investment from mining stocks, which have historically acted as indirect vehicles for Bitcoin exposure in the absence of ETFs.

- Analysis of past Halving events reveals their minimal impact on miners’ propensity to sell, noting that significant withdrawals from holdings primarily coincide with notable price upticks.

- In 2023, Texas reinforced its commitment to nurturing the Bitcoin mining sector through legislative actions, notably the enactment of Texas Bill 1929, thus positioning itself as a proactive supporter of the cryptocurrency mining industry.

- Globally, the competitive arena for Bitcoin mining is intensifying, with nations like Russia and the European Union refining their regulatory frameworks to attract mining operations.

Historical Analysis

Price developments

Bitcoin Halvings have always coincided with significant Bitcoin price increases. These events, designed to reduce the reward for mining new blocks by half, play a crucial role in Bitcoin’s scarcity and economic model. Historical analysis offers valuable insights into potential market dynamics as we anticipate the next Halving in April.

The next Bitcoin halving, expected in April 2024 at the block height 840,000, will reduce the block reward from 6.25 to 3.125 bitcoins. The crypto community closely watches this event, as past Halvings have accompanied significant price movements. The scarcity effect and increasing demand could significantly impact Bitcoin’s price in the months following the Halving.

The first Bitcoin halving in November 2012 set a precedent for the impact of halving events on Bitcoin’s price, which saw a dramatic increase from about $12 to over $1,000 within a year. This event demonstrated the potential market dynamics triggered by reduced supply growth, setting expectations for future halvings.

Following the pattern, the second Halving in July 2016, which reduced the reward to 12.5 bitcoins, was met with speculation and a gradual price increase. Although the immediate impact was modest, Bitcoin’s price eventually soared to nearly $20,000 by the end of 2017, underscoring halvings’ delayed but significant influence.

The third Halving in May 2020 further highlighted the pattern, with Bitcoin’s price climbing steadily after the reward dropped to 6.25 bitcoins, despite global economic uncertainty. This event led to a bull run, with prices reaching over $64,000 in April 2021, showcasing the resilience and growing investor interest in Bitcoin around halving events.

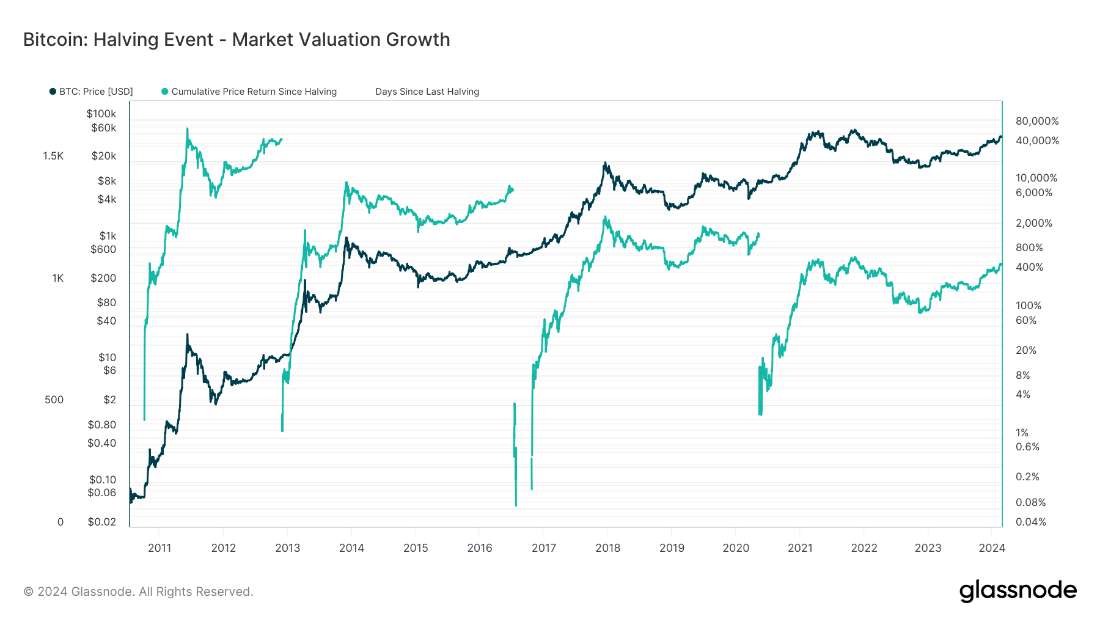

Figure 1 contains a series of indexed charts describing the growth across several on-chain metrics through each Halving Epoch. Each metric is reset to a baseline index of 100% on the date of each Halving so that market value growth occurring across the halving period can be monitored.

Figure 1: Historical Bitcoin price development after halving

Each Bitcoin Halving has been followed by an upward trend in Bitcoin’s price, albeit with some fluctuations. Statistically, 2024 falls within the critical period of 115 days before to 250 days after the upcoming Bitcoin Halving. Since 2014, the yearly returns during this specific timeframe have been 4.8 times higher than during other periods. Moreover, all major crypto bear markets have taken place outside this Halving-centric period of Day -115 to Day +250, highlighting the significant impact of halving events on market dynamics.

Seasonality Around Halving Events: A Closer Look

Analyzing price developments around halving events provide valuable insights into the crypto market. By examining these episodes within the context of price cycles, we gain a deeper understanding of their impact. Typically, Halving events occur at the end of the crypto spring, where prices are recovering from the previous cycle trough but have not yet reached a new all-time high (ATH).

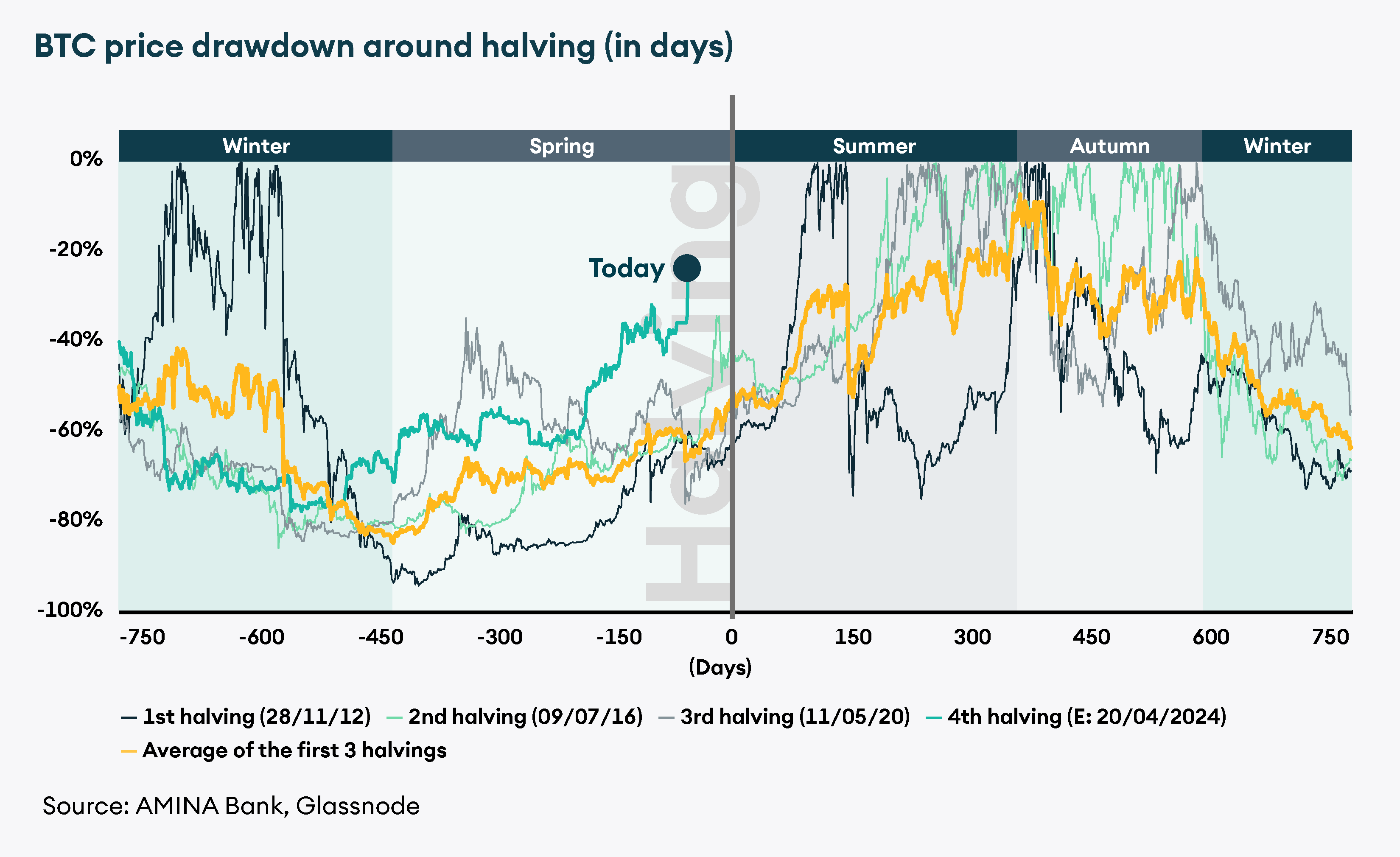

Figure 2: BTC Price Drawdown Around Halving (in days)

Figure 2 depicts the evolution of bitcoin price drawdowns around halving events. A drawdown is a statistic that measures the percentage decline in price since the last ATH. A 0% observation means the price is at ATH. Meanwhile, a -60% observation, for instance, indicates that the Bitcoin price dropped by 60% vis-à-vis the last ATH.

In Figure 2, The Halving itself happens at day zero. The chart illustrates the changes in drawdowns during the two years preceding each Halving (approximately 750 days) and the two years following it. As Halving happens every four years, this chart shows the entire drawdown cycle around the first three Halvings on November 28 2012, July 9 2016, and May 11 2020. We expect the next Halving to happen on April 20, 2024.

While each cycle around Halving is unique, there are noticeable similarities. The yellow line, which represents the average of the first three halving cycles, suggests a typical seasonality around Halving.

Between 750 and 400 days before Halving, we are in crypto winter. Bitcoin prices experience significant drops, and drawdowns from the previous ATH become more pronounced. Around 400 days before Halving, the crypto winter ends as the market bottoms out, with an average drawdown exceeding -80%.

Between 400 days before Halving and Halving, prices recover about half of what was lost. This marks the crypto spring phase. Notably, prices have shown a more robust recovery in the current cycle than the historical average.

Following the Halving and up to 350 days afterwards, prices rise further and reach new ATH levels. Drawdowns disappear during this crypto summer phase.

Between 350 and 550 days after the Halving, prices enter a late summer period, referred to as the crypto autumn. Prices remain elevated; some new ATH are printed, but less frequently than in crypto summer.

Finally, 550 days after the Halving, crypto winter begins again, initiating a new cycle.

While there is no guarantee that the cyclical pattern will repeat with the fourth Halving, the current cycle exhibits similarities to the previous three Halvings. Bitcoin price hit bottom in November 2022, about 520 days before the coming Halving, experiencing a drawdown of -75%, and has since recovered. However, compared to previous halving cycles, this crypto spring has been warmer, with BTC price only 25% below the last ATH, indicating a more robust recovery than in the past.

One notable factor contributing to this exceptionally hot spring is the Bitcoin ETF narrative, which drove up crypto prices in the second half of 2023. The approval of 11 spot Bitcoin ETFs in the US in January 2024 has further fueled expectations that institutional demand will continue to rise. Evidence of inflows into these 11 ETFs signals an increasing demand and validates these expectations, explaining the good performance of Bitcoin price in February.

Our historical analysis shows that Halving events have historically acted as positive catalysts for Bitcoin price, and the current cycle exhibits similarities to previous ones, suggesting that Bitcoin price is likely to increase further. Additionally, the approval of ETFs has bolstered institutional demand for Bitcoin and is expected to provide ongoing support for its price.

The question now revolves around the supply of new bitcoins in the market. While we know that Halving reduces the inflation rate by half, it is essential to consider the role of miners, as not all newly mined bitcoins are immediately sold on the market.

Public Miners Trends

Ordinals increase mining profitability

In recent months, Bitcoin miners have faced extraordinary conditions due to a surge in demand on Bitcoin’s blockchain, primarily attributed to the advent of BRC-20 tokens and, to some extent, image inscriptions, both facilitated by the Ordinals protocol.

Ordinals protocol allows for the inscription of unique data onto the smallest Bitcoin denominations, enabling the creation of new tokens directly on Bitcoin’s blockchain. Consequently, even minuscule amounts of bitcoin, with nominal fiat value, are being actively traded, requiring every transaction to be verified on the blockchain, particularly during the high-demand minting phase.

This shift, alongside the ability to inscribe unique data onto Bitcoin’s smallest denominations, has diversified revenue streams for miners and reduced their dependency on the halving cycle, ensuring their continued contribution to the network’s security.

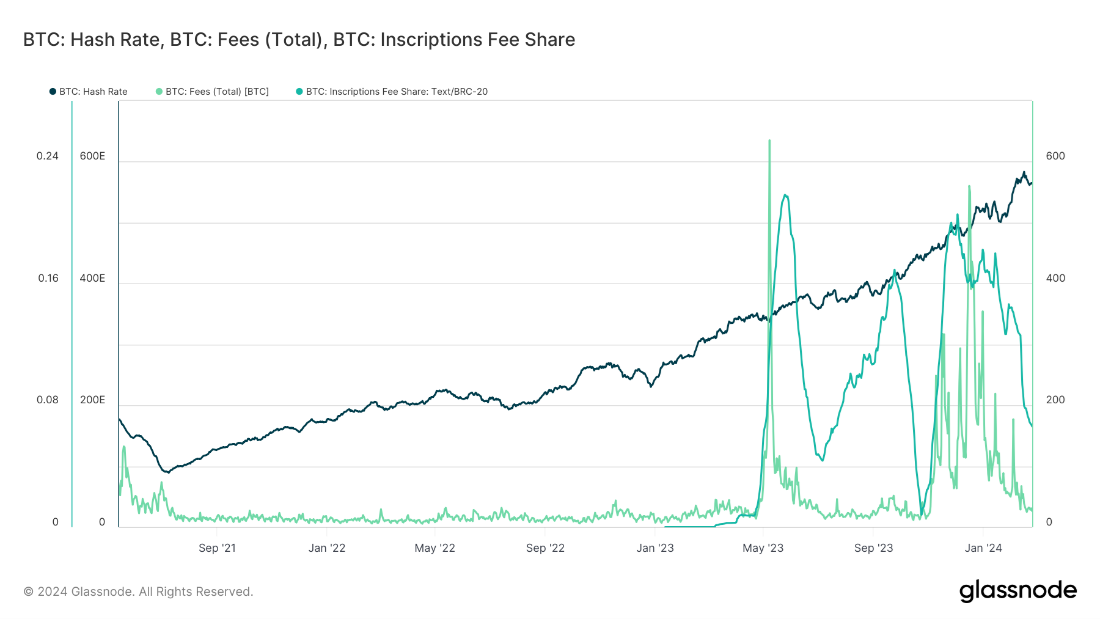

The increased network usage presents a golden opportunity for Bitcoin miners. The intensive computational processes conducted by mining hardware serve a dual purpose: generating new bitcoin and verifying blockchain transactions to ensure the smooth operation of the digital economy. With network activity at near-record highs, the priority for miners has shifted towards processing transactions, relegating the creation of new bitcoins to a secondary role. By February 2024, these dynamics have led to unprecedented mining difficulty levels, yet the mining sector is experiencing substantial profits.

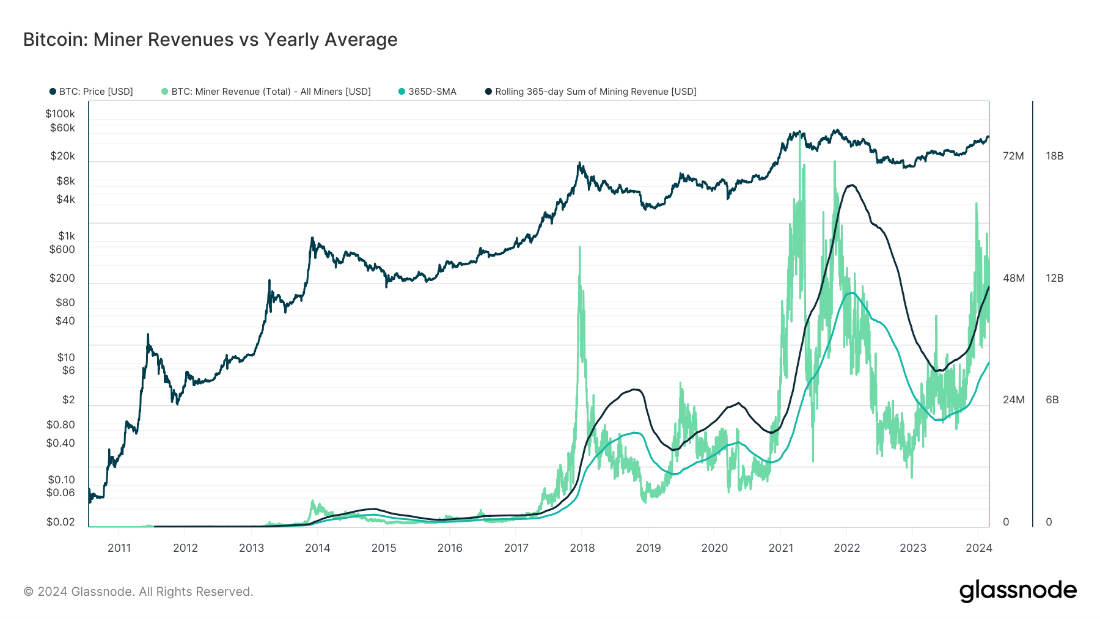

A comparison of daily USD revenue paid to Bitcoin miners against the 365-day simple moving average, as shown in Figure 3, offers insights into daily volatility versus long-term trends. This analysis introduces the Puell Multiple oscillator, a cyclical indicator derived from the daily miner revenue in USD compared to its annual average. It highlights periods of extreme profit or potential distress for miners. Additionally, the graph includes a rolling 365-day total of miner revenues, providing a comprehensive view of the industry’s overall income.

The significant rise in miner revenues since May 2023 can be directly linked to the Ordinals protocol, illustrating the protocol’s impact on the Bitcoin mining landscape.

Figure 3: Miner Revenues vs Yearly Average

The introduction of the Ordinals protocol and inscriptions has dramatically influenced the Bitcoin network, resulting in a 336% year-over-year increase in transaction fees. This surge has spurred the rapid development of Web3 applications and the tokenization of assets on Bitcoin. In 2023, inscription fees alone accounted for 10-20% of the network’s total transaction fees. The concurrent rise in Bitcoin’s price and transaction fees has notably enhanced the hash price. This enhancement, coupled with the arrival of newer, more efficient ASIC miners, has driven a significant upswing in network difficulty (up 104% year-over-year) and a 133% increase in hashrate year-over-year, marking a substantial growth phase for the network.

The fee increase is a welcome development ahead of halving as it means miners have found a new source of return to their activity.

Figure 4: Bitcoin Hash Rate, Fees and Inscriptions Share

Miners have invested in the latest technology to prepare for halving

Heading into early Q2 of 2024, miners have prioritized enhancing their fleet’s efficiency, aiming to lower the Joules per Terahash (J/TH) ratio over expanding infrastructure and capacity. A lower J/TH indicates higher energy efficiency, which is pivotal for economic viability and environmental sustainability in Bitcoin mining. This focus is especially critical as the halving event approaches, driving efforts to minimize energy costs and promote sustainable mining practices.

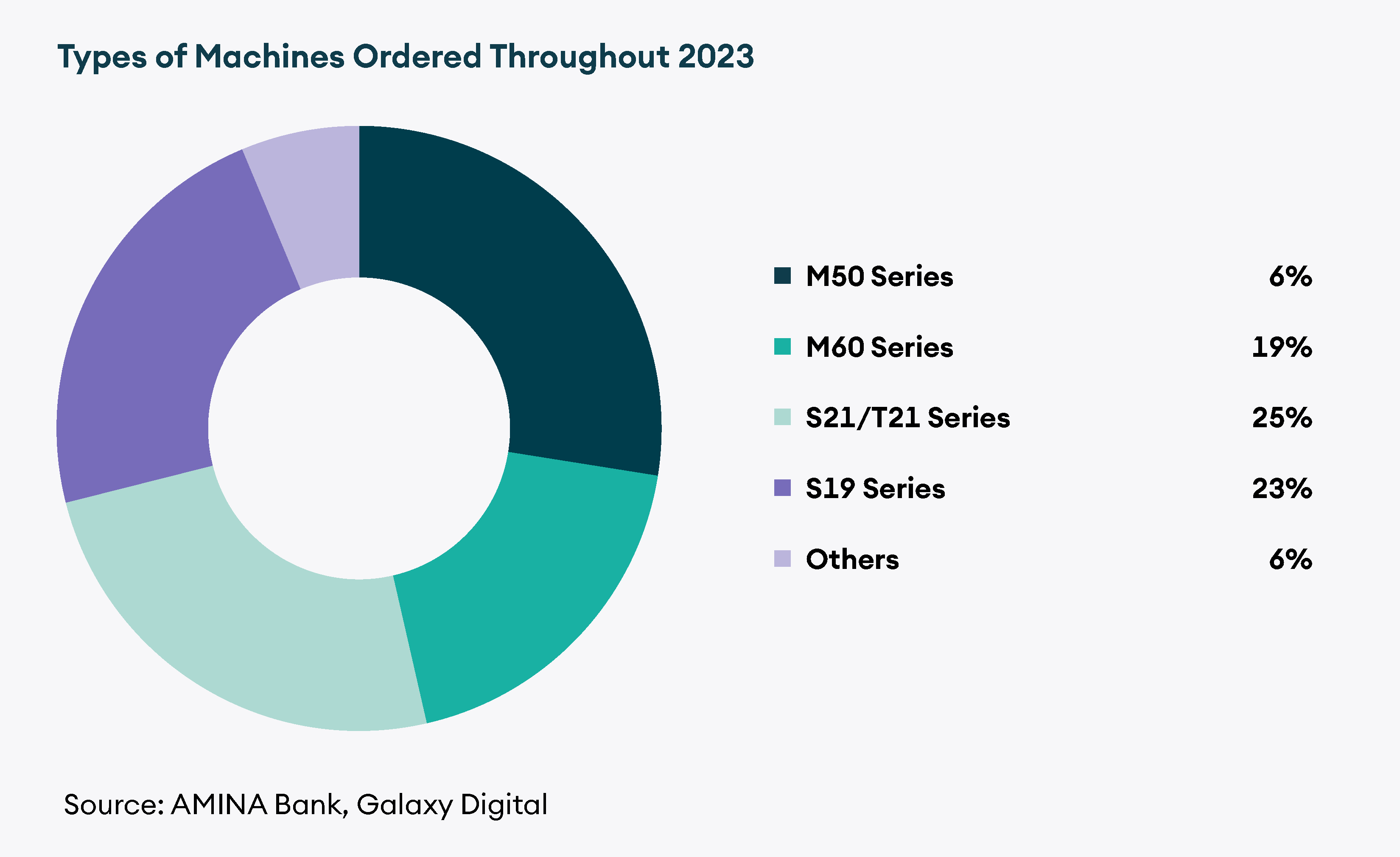

Public mining companies have invested over 94 EH (Exahash) of mining equipment throughout the year, totalling more than $1.53 billion in expenditures. This investment underscores the industry’s commitment to improving operational efficiency and profitability.

In the latter half of 2023, there was a 59.3% increase in purchase orders, from 39.4 EH to 62.8 EH, as miners sought to acquire the latest generation of mining machines. These new models, including the S21/T21 from Bitmain and the M66/M56 from MicroBT, boast efficiencies below 20 J/TH, highlighting a significant leap towards more energy-efficient mining operations.

As of 2024, miners have already spent over $393 million on new machinery, with companies like CleanSpark and Phoenix leading the investment surge. This proactive approach to upgrading their mining fleets with more energy-efficient hardware reflects the industry’s readiness for the upcoming Halving and its continuous pursuit of sustainability and profitability.

Figure 5: Types of Machines Ordered Throughout 2023 by Public Miners

We expect the Bitcoin hashrate to reach 650 – 700 EH end of this year, despite a possible 10-20% decline in the hashrate directly after halving as less profitable miners go offline. The underlying assumption is that with more efficient ASIC fleets and higher transaction fees, there could be extended block times post-halving and increased volatility in fees that miners must navigate through 2024.

Impact of ETF Approval on Miners

The approval of Bitcoin ETFs represents a significant milestone in Bitcoin’s history, with far-reaching implications for the cryptocurrency’s price and the broader mining sector. Analysts regard this development as a landmark event that could lead to a significant demand shock in the market, especially notable as it precedes the anticipated supply shock from the Bitcoin halving event expected in April 2024. This combination of demand and supply dynamics could significantly influence Bitcoin’s valuation and the profitability of Bitcoin mining operations.

However, the introduction of Bitcoin ETFs also brings about challenges for mining companies. Some industry observers have expressed concerns that Bitcoin ETFs might redirect investment away from mining stocks, which have traditionally served as a proxy for direct Bitcoin exposure in the absence of ETFs. Until the approval of Bitcoin ETFs, investors seeking exposure to Bitcoin’s price movements often turned to mining stocks as a regulated and traditional investment avenue. The arrival of ETFs could change this dynamic, potentially drawing capital away from mining stocks and into ETFs that offer direct exposure to Bitcoin’s price.

Despite these concerns, some mining companies remain optimistic, focusing on the potential for Bitcoin’s price to rise and drive higher USD-denominated revenue for miners. Companies like CleanSpark have been investing heavily in mining equipment to enhance their competitive edge, anticipating that a rising Bitcoin price and efficient operations will sustain their profitability.

Miners’ Flows

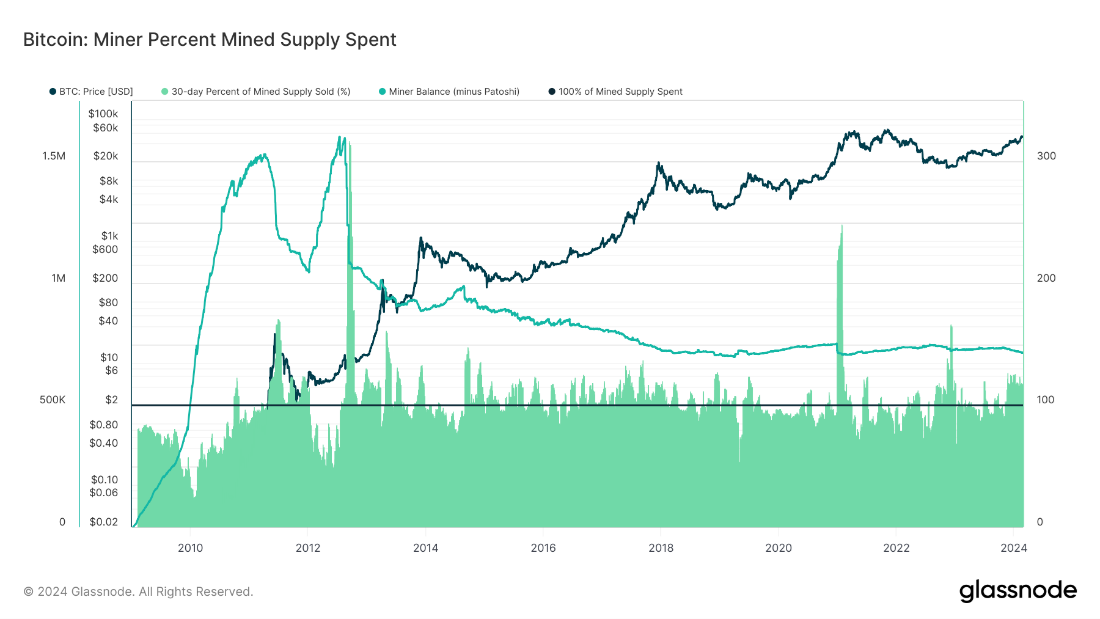

Due to their operational costs, Bitcoin miners are compelled to sell a portion of their mined Bitcoin. This behaviour is quantified by examining the percentage of the mined supply sold by miners within a 30-day period. The competitive and capital-intensive nature necessitates miners selling most of their output to cover expenses.

By comparing the change in miner balances over 30 days with the total issuance during the same period, we can gauge the overall proportion of mined coins that miners sell. Observations indicate that there are instances where miners have sold nearly all of their daily mined supply. The upcoming Bitcoin halving raises questions about its impact on miners’ selling behaviour and overall holdings, especially as the daily block reward is halved. However, historical data suggests that halvings have had minimal effect on the selling patterns of miners, with significant reductions in holdings occurring primarily during substantial price increases. It is anticipated that only a fraction of miners, particularly those with less profitable ASIC fleets, may cease operations post-halving, potentially affecting 10-20% of the hashrate.

Should miners significantly reduce their holdings, this would likely result in the redistribution of coins to new market participants, fueled by the approval of Bitcoin ETFs. Such a shift is viewed as a longer-term bullish signal for Bitcoin, suggesting a redistribution rather than a depletion of supply.

Figure 6: Miners’ Flows

Regulation

In 2023, Texas solidified its support for Bitcoin mining through legislative efforts, notably with the passing of Texas Bill 1929, emphasizing the state’s role as a forward-thinking advocate for the cryptocurrency mining industry. This legislation mandates that virtual currency mining facilities with significant energy consumption register with the state’s regulatory bodies, aligning with Texas’s broader strategy to manage the energy demands of the burgeoning mining sector efficiently.

The broader regulatory and economic landscape in 2023 also brought significant developments that bolstered the Bitcoin mining industry, such as the withdrawal of the proposed DAME Tax by the Biden Administration. This decision, alongside the forthcoming FASB rules allowing for the fair value measurement of Bitcoin on balance sheets, reflects a growing recognition of the economic potential of Bitcoin mining and its integration into the digital asset ecosystem.

Globally, the competitive landscape for Bitcoin mining is becoming increasingly pronounced, with countries like Russia and the European Union advancing their regulatory frameworks to attract mining operations. This international regulatory dynamism highlights the strategic significance of mining within the global digital asset market, suggesting that jurisdictions offering favourable conditions, such as Texas, are likely to become critical players in the mining industry.

Conclusion

The upcoming Bitcoin Halving in 2024 holds significant potential for the cryptocurrency market. Based on historical patterns, the crypto summer phase following the Halving could lead to new all-time highs. The current cycle exhibits similarities to previous Halvings, indicating a likely increase in Bitcoin’s price.

The approvals of BTC Spot ETFs have fueled institutional interest and capital inflows, contributing to the warm crypto spring.

Miners have prioritized energy efficiency, and the Bitcoin hashrate is expected to grow, despite a temporary reduction post-Halving.

Texas has positioned itself as a supportive jurisdiction for the mining industry. As global competition in Bitcoin mining intensifies, countries are refining regulations to attract mining operations.

Overall, our analysis draws a constructive scenario for the future of Bitcoin and its mining industry. If the April Halving event rhymes with previous halvings, Bitcoin price should continue to increase and test new ATHs.